Following on from the change in legislation on 6th April 2021, it is the responsibility of each organisation to decide whether a role is inside or outside of IR35.

All nursing roles are currently designated as inside IR35. This means there are two different ways for Cromwell Medical to pay our workers.

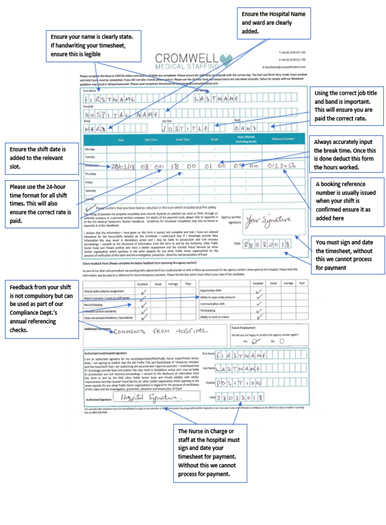

PAYE Workers timesheets are due in by 10am on Friday for payment on Monday.

Our clients can be processed in one of two ways, paper timesheets submitted by the candidate or electronically. This means we cannot process the paper timesheet submitted but wait for the electronic report from the hospital, with the shift being authorized for payment.

We always recommend you keep a copy of your paper timesheet for your records, or should any issues arise, however, we cannot pay you until we receive the electronic timesheet from the place you worked.

Holiday pay is based on the principle that a worker should not suffer financially for taking holiday. In simple terms, almost all workers, except those who are genuinely self-employed, are legally entitled to 5.6 weeks’ paid holiday per year. This entitlement is derived from the Working Time Regulations 1998.

You have the right to paid holiday ('statutory annual leave'). As a temporary agency worker, the number of days you get depends on how many days you work. You build up ('accrue') holiday from the day you start working, including when you are on:

You are entitled to 5.6 weeks' paid holiday (statutory annual leave) a year.

As a temporary agency worker, you are entitled to paid time off for every day you work.

Annual leave begins to build up (‘accrue’) as soon as the worker is paid for their first shift. Cromwell Medical uses an accrual system where by 12.07% of each hour worked is counted towards annual leave days accrued. Nothing is deducted from the worker’s pay.

Example Jane Doe worked an 11-hour shift, her accrued annual leave for this shift is 1.39 hours

11 hours x 0.1207 = 1.39 hours

Can workers pick up a shift and get paid for my annual day?

The law requires you to not work for the period you are taking annual leave. If you do pick up a shift, with Cromwell Medical, your annual leave request will be cancelled.

Income tax is a tax you pay on income. Not all types of income are subject to tax.

For a full list please visit this link.

Most people in the UK get a Personal Allowance of tax-free income. This is the amount of income you can have before you pay tax.

The amount of tax you pay can also be reduced by tax reliefs if you qualify for these.

Most people pay Income Tax through PAYE. This is the system Cromwell Medical uses to take Income Tax and National Insurance contributions before they pay your wages or pension.

Your tax code is used by Cromwell Medical to work out how much Income Tax to take from your pay or pension. HM Revenue and Customs (HMRC) will tell us which code to use.

Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year. You can also view your tax code for:

You’ll be asked to sign in with Government Gateway or create an account if you do not already have one.

Once signed in, you can also see:

You can also find your tax code on your payslip or tax code letter from HMRC.

HMRC may update your tax code if:

Emergency tax codes are temporary. HMRC will usually update your tax code once they have your correct details. If your change in circumstances means you have not paid the right amount of tax, you’ll stay on the emergency tax code until you’ve paid the correct tax for the year.

You can get £99.35 per week Statutory Sick Pay (SSP) if you are too ill to work. It’s paid by Cromwell Medical for up to 28 weeks.

Statutory Maternity Pay (SMP) is paid for up to 39 weeks. You get:

To qualify for SMP you must:

Cromwell Medical will give you SMP1 form explaining why you cannot get SMP within 7 days of making our decision. You may be eligible for Maternity Allowance instead.

Start Date

SMP usually starts when you take your maternity leave.

It starts automatically if you are off work for a pregnancy-related illness in the 4 weeks before the week (Sunday to Saturday) that your baby is due.

A workplace pension is a way of saving for your retirement that’s arranged by your employer. 5% of your pay is put into the pension scheme automatically every payday. Cromwell Medical also adds 3% into the pension scheme for you.

All employers must provide a workplace pension scheme. This is called ‘automatic enrolment’.

Cromwell Medical must automatically enrol you into a pension scheme and make contributions to your pension if all the following apply:

Cromwell Medical will email you when you’ve been automatically enrolled into our workplace pension scheme. The email will include:

To opt out of contributions you will need to contact Nest, our pension provider to do so.

Their contact information is below:

PAYE workers are paid on a Monday, providing we receive your timesheet by the previous Friday morning by 10 am.

All PAYE payslips are emailed to your personal email address from a no-reply email address. If you haven't received your payslip, we would recommend checking your spam or junk folder. If you are still unable to access your payslip, please contact the payroll team on payroll@cromwellmedical.com.